Wealth Management Firms

TIFIN Give’s intelligent donor-advised fund (DAF) platform helps firms and advisors differentiate their offering and strengthen client relationships across generations with best-in-class technology, investment flexibility, and white-label customization.

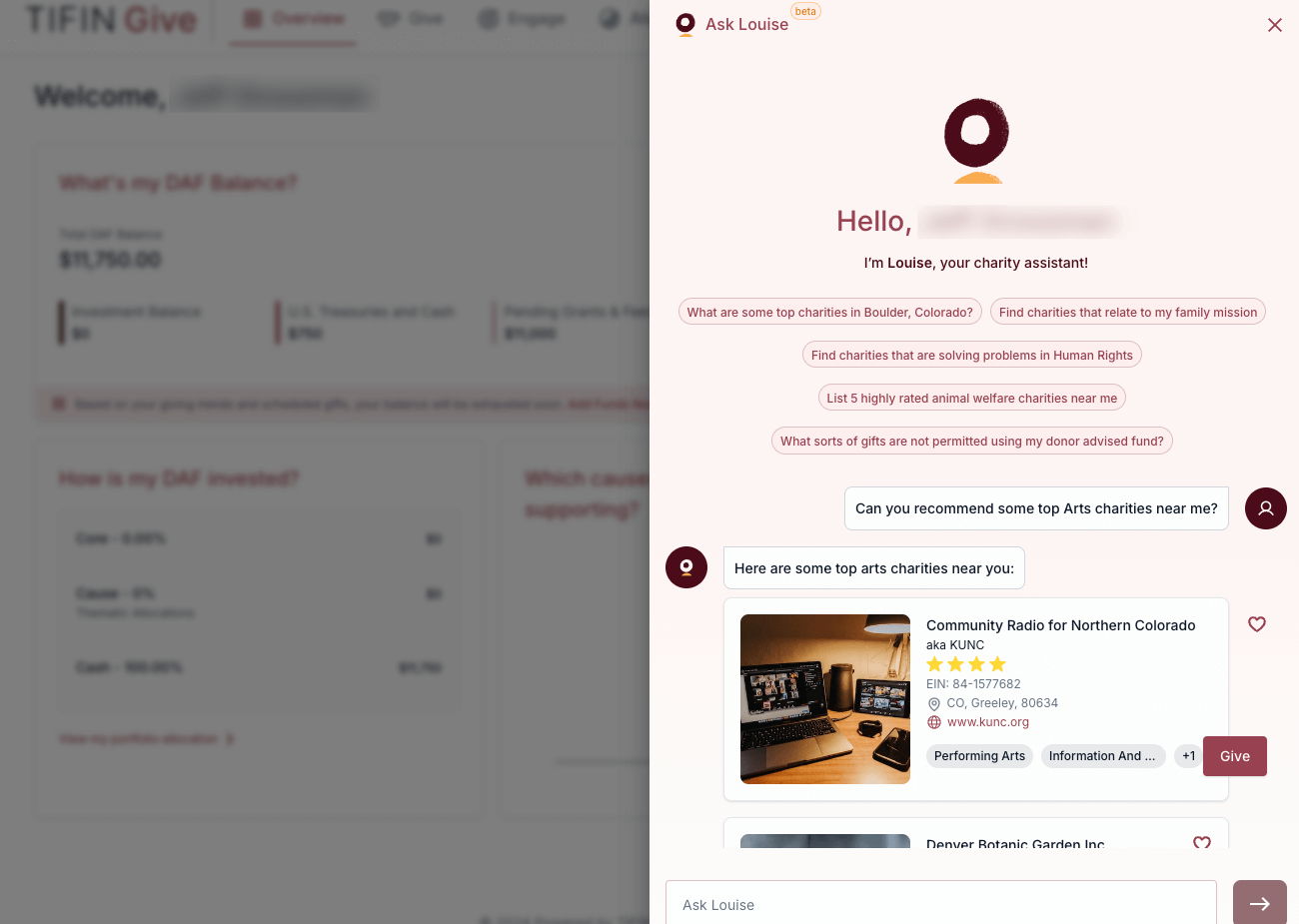

AI-Powered Philanthropy Support

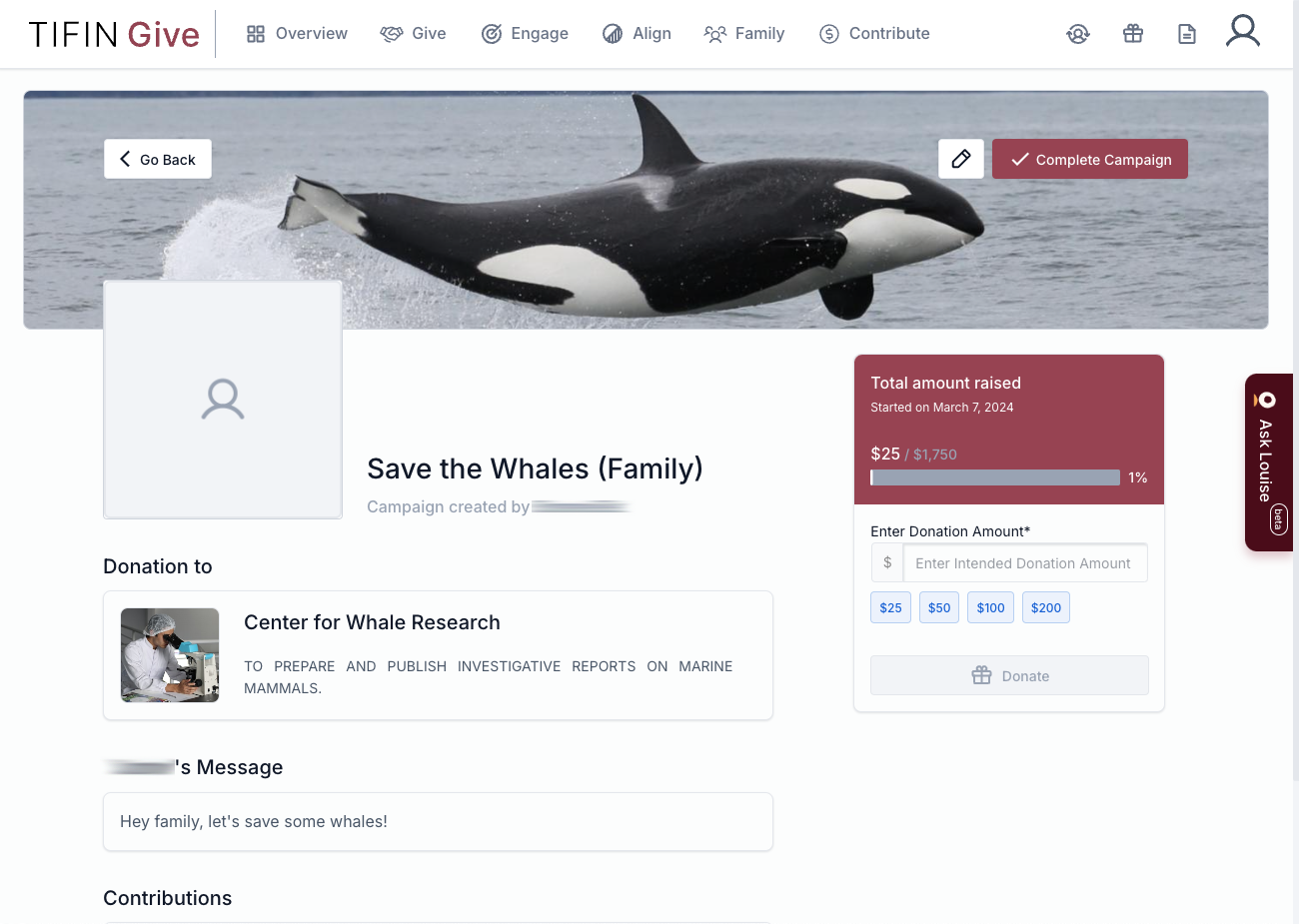

Family And Community Engagement

Create deeper connections with clients and the Next Generation by facilitating family and community engagement around charitable pursuits. TIFIN Give’s DAF platform makes it easy to share accounts and campaigns with friends & family.

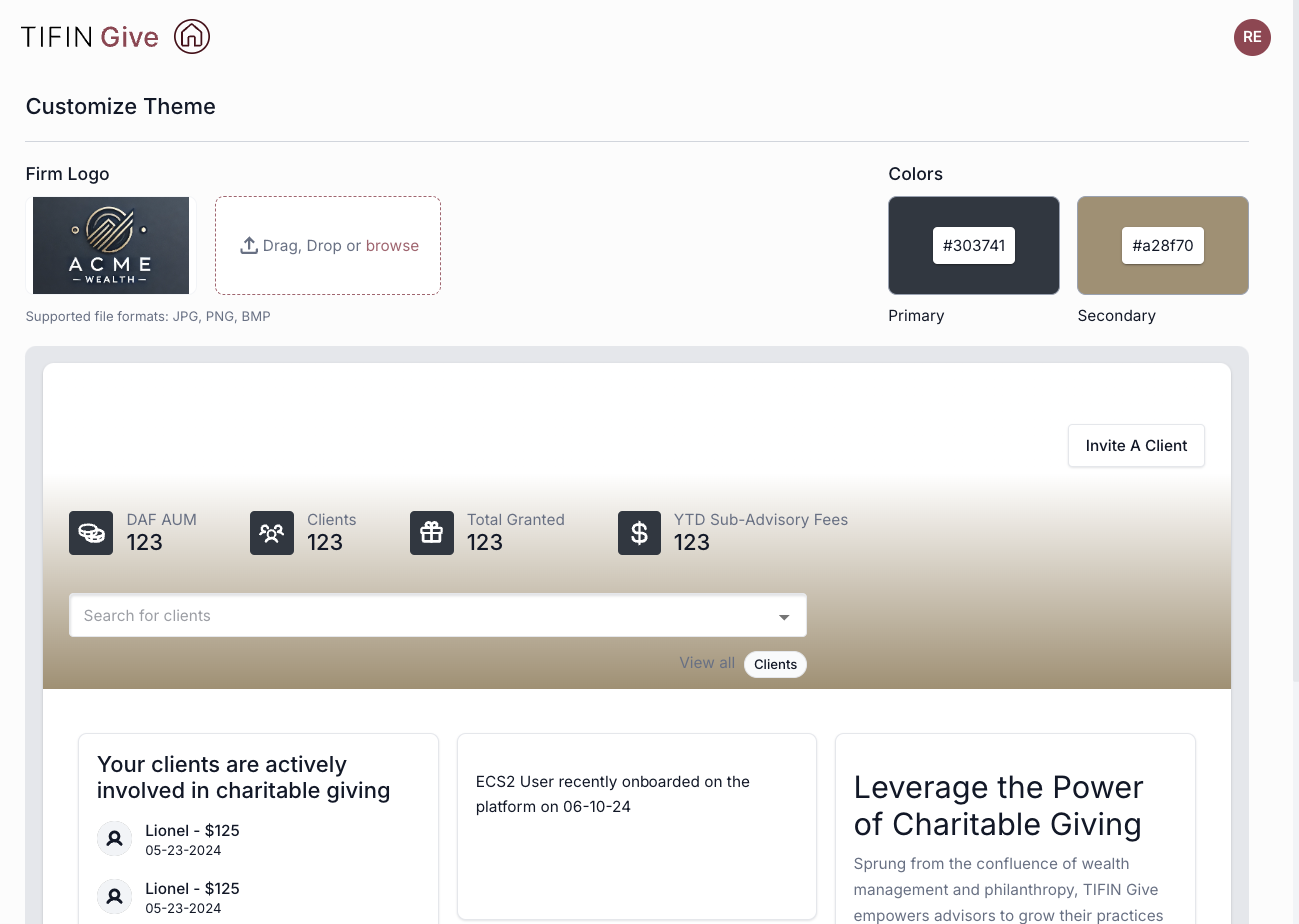

White-Label Customization

TIFIN Give’s DAF platform provides white-label customization without administrative burden. Effortlessly offer a seamless branded experience that looks and feels like your firm.

Get started. Book a demo today.

Why wealth firms use TIFIN Give

- The most flexible DAF on the market: multi-custody, investment selections, low SMA mins, funding options and aggregated giving data.

- Only DAF providing a white label solution without trading off the advisor and investor experience or creating administrative headaches.

- Offer a philanthropy experience that delights high net worth clients and does not jeopardize existing relationships.

Why advisors use TIFIN Give

- Only DAF to include the Next Gen into the platform, which helps advisors retain assets through the wealth transfer.

- Best-in-class investment flexibility including Alternatives.

- Grow your firm’s assets through broader tax management connected to direct indexing strategies.

Why families use TIFIN Give

- Only DAF that engages your family and community in the giving experience.

- Invest the way you want versus a set investment menu.

- A giving experience that is easy to use and leverages modern technology like AI to maximize your impact.

Low Fees to Maximize Giving

Maximize charitable giving dollars with a simple, low-fee structure and no hidden costs. Unlike other DAF offerings, TIFIN Give allows investment flexibility without high expenses and extends access to more donors with no account minimums.

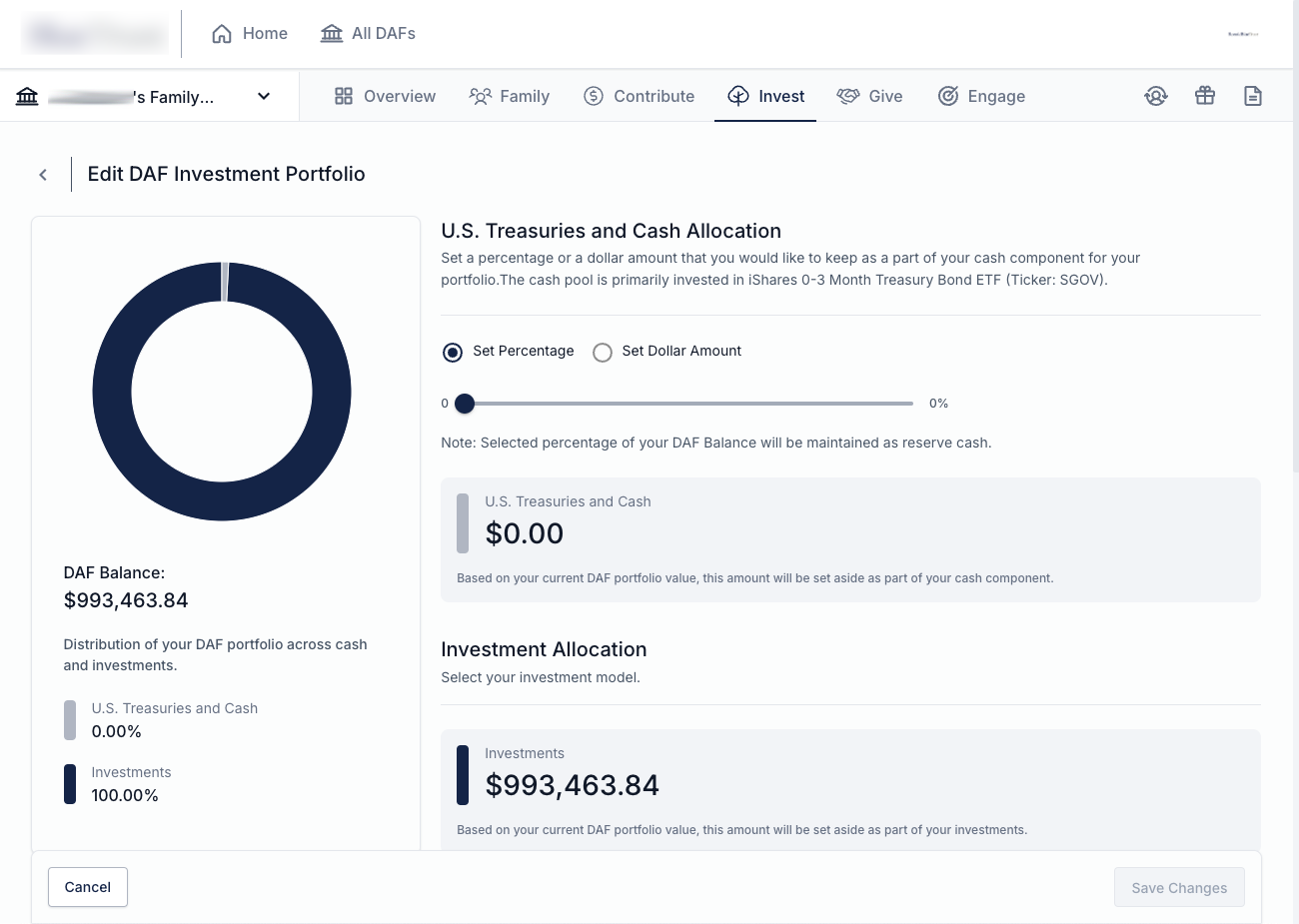

Investment Flexibility

TIFIN Give offers unmatched investment flexibility with options ranging from pooled funds to Alternatives, curated funds, and low-minimum SMAs starting at just $50,000. What’s more, cash can be invested in short-term, industry-leading funds to provide growth opportunities no matter your timeline for granting.

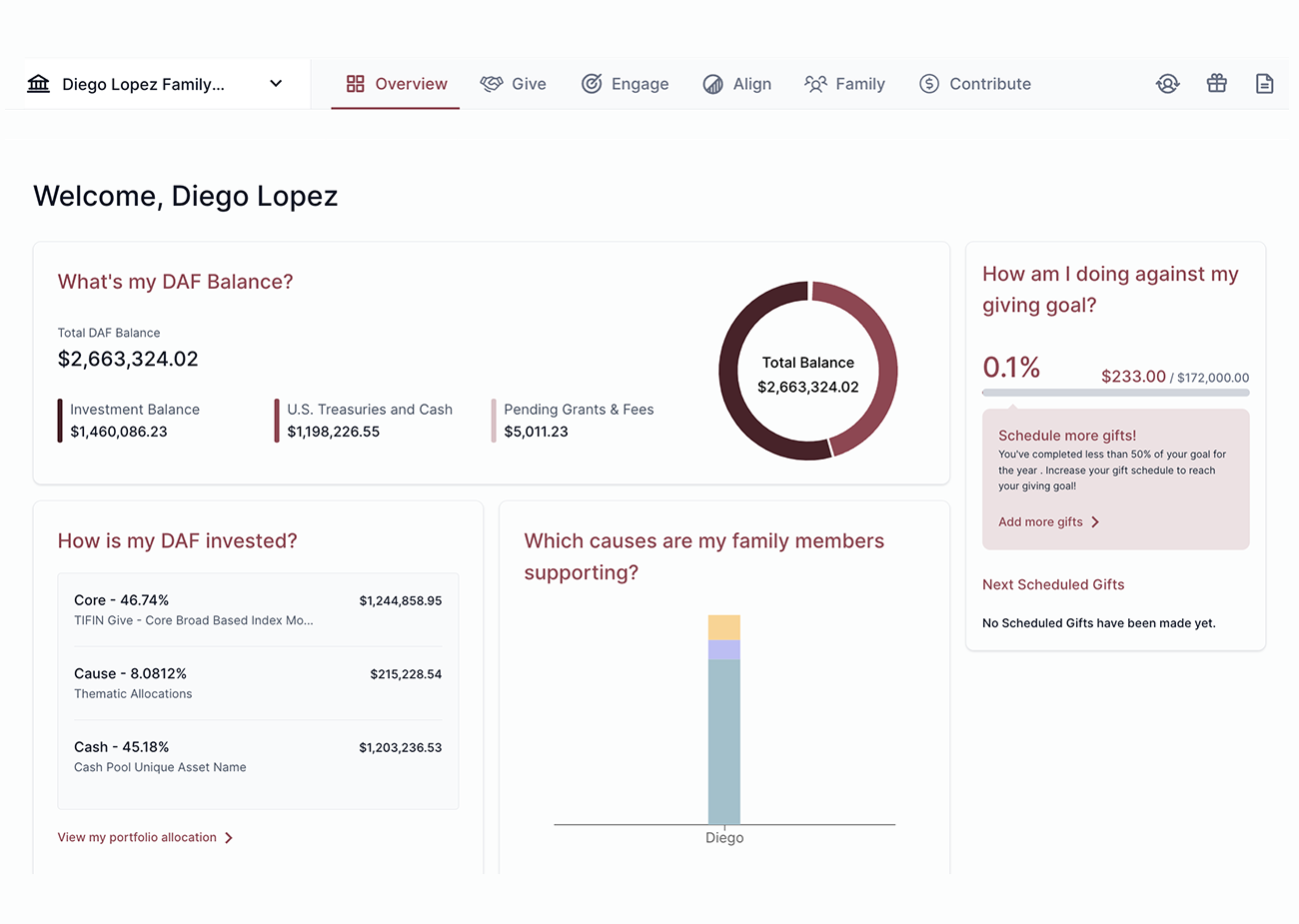

Centralized Dashboard

Manage unlimited accounts and collaborate with advisors from a centralized dashboard.

Rapid Onboarding

Onboard your clients in a fully-digital flow in just a few clicks. It’s never been faster to get your client accounts up and running.

Single-Charity Funds

Take advantage of innovations like “single-charity funds” which allow transfers from IRA to generate additional tax deductions while helping meet mandatory distribution requirements.

Single-Sign-On & Platform Integration

No more logins. Simplify your advisor and client experience with single-sign-on integration and connectivity with other common wealth platforms.

Streamlined Contribution Flows

Fund client DAFs with streamlined contribution flows—ACH wia Plaid, Cash/Wire Transfers, Credit Card, Public Securities, DAF-DAF Transfers, Complex Gifts.